By Leo Brine

Last Thursday marked the end of the 2022 legislative session. Lawmakers only had 60 days to pass legislation, write and pass two supplemental budgets, and pass a transportation spending package. At the outset of the session, Democrats, who have a 57-seat majority in the house and a 29-seat majority in the senate, said they wanted to pass bills to help with housing affordability, homelessness, environmental sustainability, and the economy.

When it comes to housing, Rep. Nicole Macri (D-43, Seattle) told PubliCola, “it was not a great year in terms of policy.” Macri pointed out that Democrats killed Rep. Jessica Bateman’s (D-22, Olympia) bill to allow denser housing statewide (HB 1782) and Rep. Sharon Shewmake’s (D-42, Bellingham) accessory dwelling unit (ADU) bill (HB 1660), both of which could have helped the state increase its housing stock. Bateman’s bill would have required all Washington cities to include denser housing options, like fourplexes and courtyard apartments, in neighborhoods zoned for single-family housing, while Shewmake’s would have permitted mother-in-law apartments and backyard cottages in all types of residential neighborhoods.

When it comes to housing, Rep. Nicole Macri (D-43, Seattle) said “it was not a great year in terms of policy.”

The legislature also killed Rep. Strom Peterson’s (D-21, Lynnwood) tenant protections bill (HB 1904), failing to vote on it by the first legislative deadline. Michele Thomas from the Washington Low Income Housing Alliance said it was “one of the biggest losses of the session,” adding, “Democrats in the House shouldn’t have been afraid to vote on that bill.” The bill would have required landlords to give tenants six months’ notice before increasing rent; capped fees for late rent payments at $75; and provided tenants who could not afford a rent increase assistance moving somewhere they could afford. Thomas said the bill was tame and didn’t propose any kind of rent control, typically a third rail for legislators.

Democrats did manage to pass some homelessness bills that will provide temporary help to people living on the streets. The house and senate passed Rep. Frank Chopp’s (D-43, Seattle) bill that attempts to connect people under the state’s Apple Health (Medicaid) program with permanent supportive housing (HB 1866). Although the bill initially passed without funding, Democrats secured $60 million for the program in the capital budget. Macri saw the provision as a necessary upgrade. “Being on the budget team, I tried to focus on making sure we had strong investments because we didn’t have the strong policy I wanted to see pass,” she said.

To respond to the ongoing climate crisis, which is only getting worse, Democrats used their transportation package to try and reduce the state’s overall emissions by investing in electrified ferries, expanded transit services and better bike and pedestrian infrastructure.

Climate Solutions Washington Director Kelly Hall said she was pleased with the investments Democrats made with the transportation package and hopes they will allocate more of the funding from the transportation package toward electrifying heavy-duty machinery, like long-haul trucks and construction vehicles, between now and the 2023 legislative session.

While Hall supports the transportation package, she said the legislature failed to pass bills that would reduce emissions from the state’s gas-heated buildings and from other common polluters people don’t often think of. Hall pointed out Rep. Macri’s bill (HB 1918) would have exempted the purchase of energy efficient lawn equipment from the state’s sales tax and encouraged more people to ditch their gas-powered leaf blowers and lawnmowers for zero-emission models. Gas-powered lawn tools “emit a lot of toxic air pollution right in our communities,” Hall said.

The forecast isn’t all doom and gloom for Washington’s climate and environment, though. Democrats passed Rep. Joe Fitzgibbon (D-34, Seattle) bill (HB 1812) that gives the state more power to site and help set up renewable energy plants and zero-emissions manufacturing facilities in the state. “As we start to implement some of these clean energy laws the legislature has passed,” Hall said, “it’s crucial we bring [clean energy] jobs to Washington and become a clean energy technology leader.”

As inflation hit 7 percent in December and rose to 7.9 percent in March, Republicans urged Democrats to pass tax cuts. To the relief of progressive tax policy experts, like those at the Washington state Budget and Policy Center and Economic Opportunity Institute, Democrats didn’t take the bait. “The legislature is lauded for [not passing] wasteful tax cuts that would unnecessarily benefit wealthy people,” said Andy Nicholas, senior fellow at the Budget and Policy Center.

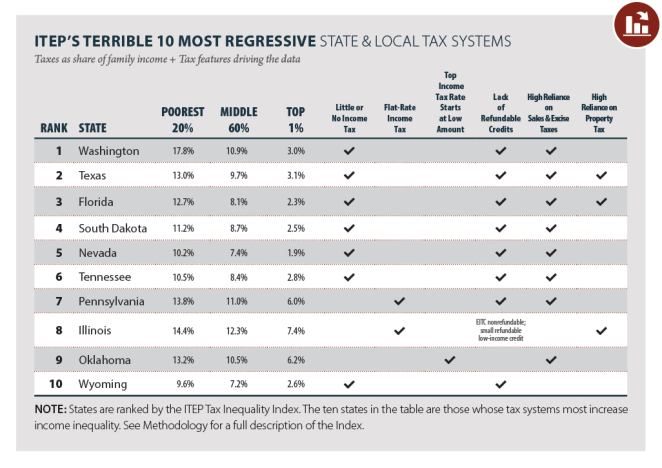

However, advocates said the legislature failed to take action this year to fix Washington’s regressive tax code. The wealth tax (HB 1406) was reintroduced this year but never made it out of committee in the House, nor was a bill that would have made the estate tax more progressive (HB 1465).

“We really didn’t do anything to address the upside-down nature of the tax code,” or the structural problems of the tax code that “continue to provide less and less funding for state government,” said EOI policy director Marilyn Watkins.

Democrats have routinely said the state’s tax code overburdens the state’s lowest-income residents. Last year, Democrats used this as a rallying cry to pass the capital gains tax. But this year, Democrats did not push for additional reforms to the state’s tax code. Next year, a bipartisan, bicameral tax structure work group is expected to introduce bills that would take direct aim at the tax code, but advocates don’t see why lawmakers didn’t ge the ball rolling on some of those bills this year.

“We really didn’t do anything to address the upside-down nature of the tax code” or structural problems within the code that “continue to provide less and less funding for state government,” said EOI policy director Marilyn Watkins.

While advocates were disappointed with Democrats’ inaction on taxes, they were pleased to see that they let Rep. Dave Paul’s (D-10, Oak Harbor) sale tax holiday bill (HB 2018) die. “That would fall under the bucket of not doing anything meaningful to help with inflation,” Nicholas said.